For the 26 years that Catherine Schweitzer has worked at the Baird Foundation, a nonprofit based in Buffalo, New York, her organization has relied in part on a peculiar income stream: the mouthwash Listerine.

Every year, a small portion of the global revenue from the iconic mouthwash trickles back into the bank account of the Baird Foundation.

Neither Schweitzer nor the Baird Foundation has any direct connection to Listerine or to Johnson & Johnson, the company that now manufactures it.

But the nonprofit is one of dozens, if not hundreds, of entities that own royalty rights to Listerine — a group that has included former New Jersey governor Chris Christie and Wellesley College.

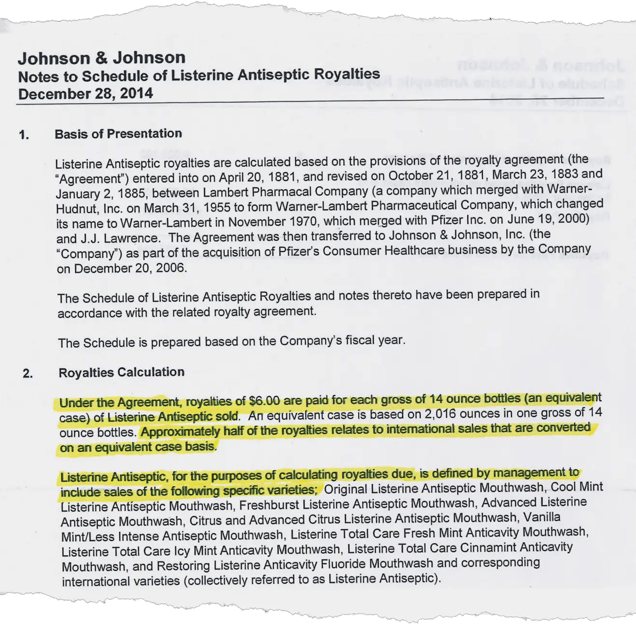

For every 2,016 ounces of Listerine sold (equivalent to 144 14-oz. bottles), Johnson & Johnson pays a total of $6 to Listerine’s royalty holders.

Most of the time, the Baird Foundation’s 0.5% share in the Listerine royalty trust totals to about $120k per year in passive income, split into quarterly installments paid by Johnson & Johnson. It’s a great investment, according to Schweitzer: “stable predictable cash on an annual basis.”

For most of her career, Schweitzer didn’t understand how the foundation had acquired the Listerine stake in the first place.

But in January 2017, a representative for the estate of a wealthy man from Buffalo, New York, reached out to Schweitzer, asking if the Baird Foundation wanted to buy another half-share of the Listerine royalty trust. She volunteered to investigate where their stake came from.

Over the next month, Schweitzer dug through her organization’s records. She discovered that Ivan Obolensky, a stockbroker and the descendent of Russian nobility, had privately sold a stake to the Baird Foundation decades ago.

“He was rubbing elbows with the who’s who, people in finance, people in philanthropy, and so the opportunity came to him” to sell a stake in the Listerine royalty trust, Schweitzer said.

Schweitzer decided to bid on the new Listerine royalty offer in 2017, but ultimately, the Baird Foundation didn’t win it. Their bid — which Schweitzer remembered as being between $1.25m and $1.35m —wasn’t enough, and the stake went to someone else.

A Listerine royalty statement from 2014 (via The Baird Foundation)

By all accounts, most of the sales of Listerine have happened this way: as a private auction between organizations and wealthy individuals in the know.

Today, though, Listerine auctions are increasingly coming out of the shadows:

- In 2020, the website Royalty Exchange opened up a small share of Listerine royalties to public bidding for possibly the first time in the history of the mouthwash. One partial share sold for $561k.

- This past May, in another auction, an anonymous bidder won the rights to a larger royalty share for $1.795m.

In 2022, investors are parking more and more of their money in an asset class called royalty trusts, a category that includes everything from Bob Dylan’s songwriting catalog and oil wells.

But the Listerine royalty trust remains singular — a mass-market product whose publicly traded manufacturer is on the hook for royalty payments in perpetuity.

And it’s all thanks to the quirks of a haphazard, 19th-century contract.

How the Listerine royalty came to be

The inventor of Listerine, Joseph Joshua (J.J.) Lawrence, was a doctor and drug developer who fought in the Civil War.

In the late 1860s, Lawrence formed a chemical lab in Baltimore, Maryland, where he began testing various mass-market products. After attending a talk by a scientist named John Lister, Lawrence decided to create a formula that could comfortably clean and disinfect wounds.

Joseph Joshua (J.J.) Lawrence, the inventor of Listerine (via Find a Grave)

The new antiseptic didn’t catch on. So when a local pharmacist named Jordan Wheat Lambert asked to buy the formula, Lawrence didn’t have a problem licensing it out.

Lawrence scrawled the original contract for the sale of Listerine by hand on a copy of Medical Brief, the medical publication that he owned.

Signed April 1881, it stated that for every gross (144 bottles) of Listerine sold, Lambert would “hereafter” pay Lawrence’s “heirs, executors or assigns” $20. By 1884, Lawrence had reduced his stake in the Listerine royalty down to $6 per 144 bottles.

Lawrence likely didn’t think much of the concession. Lambert was a small-time pharmacist, and the product wasn’t generating much enthusiasm on the market.

But that would soon change.

When Lambert died in 1889, Lambert’s son took over the company. Rather than just pitching Listerine as an antiseptic, he decided to emphasize its ability to remove mouth odors.

The contract that Lawrence and Lambert signed, it turned out, had one glaring flaw: The two men never specified an end date for the royalty payments. As long as Listerine was sold, Lawrence and his heirs would get their $6 cut.

Neither man likely could have imagined that, 140 years later, the mouthwash would become a household staple worth more than $500m globally.

The splintering of a mouthwash fortune

By the turn of the 20th century, Listerine was gaining traction across the country. A 1901 article dubbed it as “the very best mouth wash known.”

But J.J. Lawrence had other concerns.

In 1906, Lawrence’s only heir, his 15-year-old granddaughter, Vera, ran away to marry Russell Hopkins, the scion of a wealthy banking family who, among other things, constructed a private zoo on his 88-acre estate in Westchester, New York.

When J.J. Lawrence died in 1909, Vera Hopkins became the direct inheritor of the Listerine royalties. Five years later, Listerine became the first over-the-counter mouthwash in the country, and sales exploded.

LEFT: An ad for Listerine (1928); RIGHT: A bottle of Listerine (1931; Dick Whittington Studio/Corbis via Getty Images)

Between 1909 and 1928, the Hopkins family received over $4m in royalties from Listerine (~$65m today).

Those revenues would only balloon as sales increased: Between 1925 and 1950, the Lambert Pharmacal Company sold $187m worth of Listerine — ~$4B worth of product today.

When Vera and Russell died, their four children divided up the Listerine royalties. Their oldest son, John Randolph Hopkins, took the biggest share, and split the rest with his sisters: Susan Whitmore, Minnie Miller, and Josephine Graeber.

But even the massive stake that John Randolph now owned in Listerine couldn’t keep up with his expensive tastes.

As an adult, John Randolph became known for his lavish, playboy lifestyle. He owned multiple yachts, hired a private pilot, and, in 1946, paid $150k ($2.5m today) to buy Tarpon Island, a private island off the coast of Palm Beach.

But this royalty-funded lifestyle wouldn’t last.

In 1950, Hopkins sold his 50% stake in the Listerine royalty trust to a real estate mogul named John J. Reynolds for $4m ($48.5m today) and began his downward spiral.

The same year, he was indicted for tax fraud. By the end of the decade, Hopkins had lost nearly all of his money, and was admitted to a mental hospital in Las Vegas. When he pleaded guilty to fraud in 1960, newspapers reported that he was living in a “filthy shack” in New Mexico.

After Hopkins, the Listerine royalty trust continued to splinter.

Reynolds, who’d bought the stake off Hopkins, in turn sold it to the Catholic Archdiocese of New York. The church held a 50% stake in the Listerine royalty trust for nearly two decades, earning a total of $13m in less than 16 years.

Catholic Archdiocese of New York owned a 50% stake in Listerine royalties for nearly two decades, raking in ~$13m over 16 years (Michael M. Santiago/Getty Images; edited by The Hustle)

In 1966, the archdiocese sold off its share to an assortment of pension funds, colleges, and hospitals. Over the ensuing years, a number of institutions and firms bought stakes, including:

- Wellesley College

- The American Bible Society

- The Salvation Army

- The Rockefeller Foundation

- The Bell Telephone Company

Meanwhile, the corporate owner of the mouthwash also started to change:

- 1950s: The Lambert Pharmacal Company merged to become Warner-Lambert

- 2000: Pfizer acquired Warner-Lambert

- 2008: Johnson & Johnson bought the rights to sell Listerine

These new owners weren’t happy about the Listerine contract, especially after the formula for Listerine entered the public domain in the 1940s.

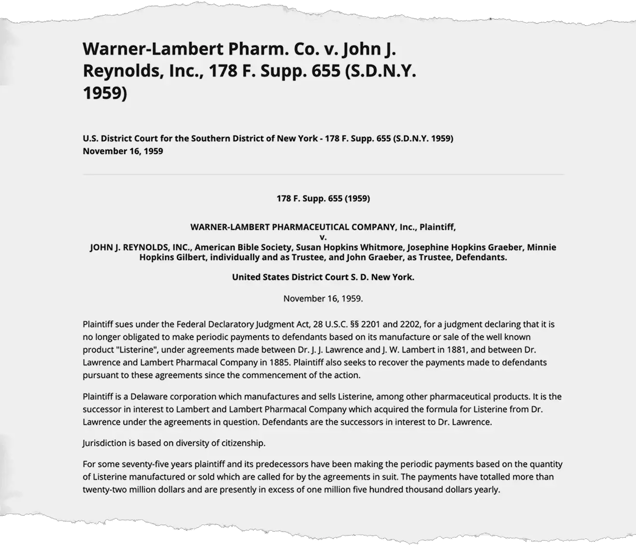

In 1959, Warner-Lambert sued to terminate the royalty contract that J.J Lawrence had negotiated. Because the Listerine formula was no longer secret, the company argued, it should not need to pay out royalties to the descendants of the inventor.

But in a landmark case that’s still taught in law schools today, a New York court sided with the royalty owners.

Warner-Lambert Pharm. Co. v. John J. Reynolds, Inc. (1959) determined that Listerine royalty holders were entitled to continued payments (via Justia)

To sunset a perpetual contract without cause, the court said, “would be to rewrite the contract for the parties without any indication that they intended such a result.”

The new class of Listerine holders

Today, the group of Listerine owners includes universities, Catholic dioceses, wealthy individuals, environmental nonprofits, and more:

- Former New Jersey governor Chris Christie owns a fractional share of Listerine, from which he earned ~$24k in 2015, when he last disclosed his tax returns.

- Fisk University, a historically Black college in Nashville, made $121.7k from Listerine royalties in 2016.

- In 2020, the Diocese of Rockville Centre, based in Long Island, New York, valued its Listerine holdings at $4.4m.

- A nonprofit named for the creator of Life Savers, the Edward John Noble Foundation, reported $249.2k in Listerine profits in 2019.

- Even the Musicians Emergency Fund, a group that provides financial support to musical artists, owns a stake of Listerine that it values at $270k.

- And some of that money is still in J.J. Lawrence’s family: the Josephine Lawrence Hopkins Foundation, named for one of the sisters of John Randolph Hopkins (and a great-granddaughter of Lawrence), has a $1m stake in Listerine.

Many of these organizations have had a stake in Listerine for so long that they no longer know where it came from.

The Henry Luce Foundation, named for the founder of Life and Time, owns $1.8m worth of Listerine royalties. The company told The Hustle that its stake goes back at least 20 years, but it can’t recall its origins.

Sometimes, Listerine royalties can account for a significant share of a company’s revenue:

- Christ Church Oyster Bay, a church on Long Island, makes about $90k per year from Listerine. That’s equal to about 10% of the church’s annual earnings.

- The Boyce Thompson Institute, a research organization devoted to plant science, bought its 1% Listerine royalty stake in 1967. The group paid $350k for the stake; in 2014, it said it had made $2.42m from the royalties.

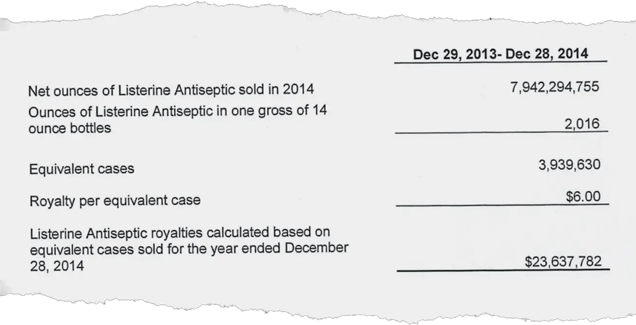

Listerine’s 2014 royalty payout (via The Baird Foundation)

In a report from 2014 obtained by The Hustle, J&J calculated that it sold 7.9B net ounces of Listerine worldwide. In the parlance of the original Listerine contract, that was equal to about 3.9m grosses of 14oz bottles.

That year, the company paid out $23,637,782 to royalty holders.

A cautionary tale in contract law

The story of the Listerine royalty trust is a “cautionary tale” for law students today, said Jorge L. Contreras, a law professor at the University of Utah who wrote about the Listerine case in a recent book on IP law.

“It’s an important case even though it is a little quirky and unusual,” Contreras said, “because it does show us that there’s nothing illegal or impermissible about having a perpetual royalty.”

Most types of intellectual protections (trademarks, copyrights, patents) have a built-in expiration date: Patents automatically expire after 20 years, at which point a company can no longer charge a royalty.

Listerine’s formula, however, was a trade secret — and a trade secret, the court ruled, can have a perpetual royalty contract.

Of course, the Listerine royalty fortune has lost some of its luster since the 1960s.

Because the original contract was negotiated for a flat fee of $6, rather than a percentage of the mouthwash’s revenue, the value of the stake has, and will, continue to decline with rising inflation: $6 in 1881 is the equivalent to ~$172 today.

But royalty holders don’t seem to mind much.

Schweitzer said the Baird Foundation has been paid out ~$120k every year for the past decade. When a news story about mouthwash sales pops up, she’s quick to share it with her trustees.

“We’re basically content to let those checks come in and put the money to work,” she said.