NOTE: This is an edited transcript of our full podcast interview with Ray Dalio. If you prefer audio, you can listen to it in full here.

Ray Dalio is the founder and co-chief investment officer of Bridgewater, the largest hedge fund in the world. He’s one of the 100 richest people on Earth. He’s also a bestselling author.

I recently sat down with Dalio to talk about his latest book, The Changing World Order, which uses a historical lens to examine why empires rise and fall — and why the US may be showing some signs of decline.

We covered a range of topics about the economy and Dalio’s life, including:

- The 3 biggest issues America is facing right now

- What’s driving the debt crisis

- The growing wealth gap (and what we should do about it)

- Thoughts on inflation and an impending recession

- Investing during times of volatility

- Whether or not crypto can become a reserve currency

- Dalio’s worst (and best) failure as an investor

- Billionaire personality tests

- How Dalio helped McDonald’s launch chicken nuggets

The conversation below has been edited for clarity, and annotated with additional context where necessary.

***

ZACHARY CROCKETT: We are in a moment where a lot of people, particularly young folks, feel disenchanted with the American dream. You’ve spent a lot of time studying the markets from a historical perspective. What would you say to those of us who haven’t lived through a time quite like this before?

RAY DALIO: There are three [things] that are happening in the US right now:

- First, the creation of enormous amounts of debt and the printing of a lot of money. This results in inflation, which takes buying power away from people.

- Second, internal conflicts. Political conflict between the left and the right, the haves and the have-nots, and people with different values.

- And third, a great power conflict on a global stage. In 1945, the US had 80% of the world’s gold, and we [accounted for] 50% of the world’s economy. And we had a monopoly on military power. And now that gap has narrowed.

The Hustle

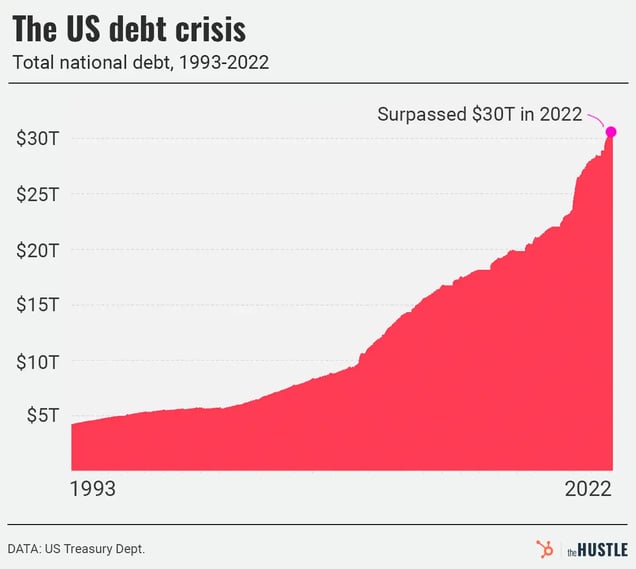

Let’s walk through each of those a little bit more, starting with debt creation. The national debt is now at $30T. It’s up $7T since 2019 alone. How did we get here?

Creating credit stimulates. Whenever you get a bad situation, you get this very heavy dose of credit. But credit produces debt that builds up over a long period of time.

In recent times — first the 2008 recession and now covid — there was a desire to give people a lot of money. So they created a lot of debt as a big stimulation and printed a lot of money to make it easier to pay that debt.

Moving to internal crises, you spend a lot of time discussing class divisiveness in The Changing World Order.

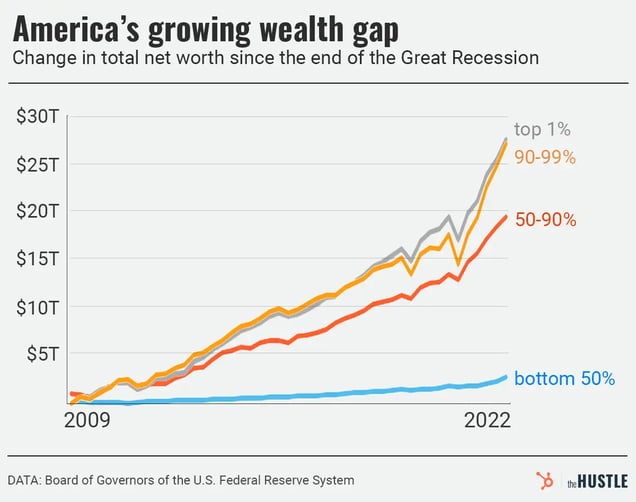

During the pandemic, billionaires saw their wealth surge by 70%, to $2.1T. I think we can probably both agree that capitalism run amok is not good. In your opinion, where does the current version of capitalism fall short?

It falls short in delivering the basic results.

I’m a capitalist. I believe in capitalism. But I think everything’s got to be reformed. The bottom 60% of the population has not had a rise in per-capita income since 1980. There are big opportunity gaps in areas like education.

We’re going to need radical reforms in order to rectify that.

Well, the left wants redistribution. The right wants trickle-down policies. In your opinion, how do we fix these inequities?

I almost don’t care what’s done as long as it’s bipartisan.

The most important thing is that we have to develop a solid middle — a bipartisanship of smart people who can work together across party lines to make the reforms. We can get into a type of civil war if the two extremes are fighting. This has happened repeatedly in history.

A fairer society minimizes these conflicts.

There are smart investments that can be made. Investments in education, for example, and ensuring that no school district falls below a certain level. If you want to look at what countries did well historically, they invested in infrastructure. It’s a good investment.

The Hustle

How about a billionaire tax?

Well, I think that there needs to be a transfer of wealth. Not just a transfer of wealth, but a transfer of education and opportunities.

That’s going to have to come significantly from taxes, and the wealthy can pay for it better. So, I think that’s inevitable that that would and should come.

Now the form of the tax is a different question. How does it work? When you have a wealth tax, that requires you to be able to value all those assets. Some of those assets are not easy to value. They’re illiquid.

Inheritance taxes might be a more effective solution.

In any case, my generation has left the next generation — your generation — with a broken-down infrastructure and a lot of borrowed money. That’s a problem.

You don’t often hear that admitted aloud.

Well, it’s just a fact.

Let’s discuss your third point, which is a shift in the “world order.” You think that China may eventually usurp America as the world’s leading superpower. What indicators is this based on?

It is inevitable that China will be a comparable power. It is likely that it will pass the US, but not certain. It’ll all depend on how much the United States takes care of itself.

China has a population four times that of the US. If its per-capita income was even half that of the US, it would be twice as large economically. I first started going to China in 1984. Since then, its per-capita income has increased by 26 times.

We can’t discount China, and we know that we’re in a different world than in the early years of me growing up when the United States was the dominant power.

We’re going to have a great power conflict. And there are no courts that you go to when you have disagreements; it’s a power conflict. What matters most is power. And so we better get stronger, or expect that we have to deal with that power conflict. Ideally in a way that does not produce a military war.

China has many problems of its own: a population is aging, opaque financial markets, severe internal social and cultural injustices. Do you see these as potential threats to its rise?

China has a number of challenges.

Despite those challenges, it’s likely that they will grow at a faster pace than we will grow at because they are being very productive.

Would it really be that bad to be, say, the third or the fifth most powerful country in the world? What do you lose when you lose that top spot on the throne?

I think that top spot is way exaggerated.

To some extent, you can control things more when you’re in the top spot. But going to war and leading those wars is terribly dangerous. And maintaining that top spot is very costly. The US has bases in 70+ countries.

So yeah, being number one has its own problems.

The Hustle

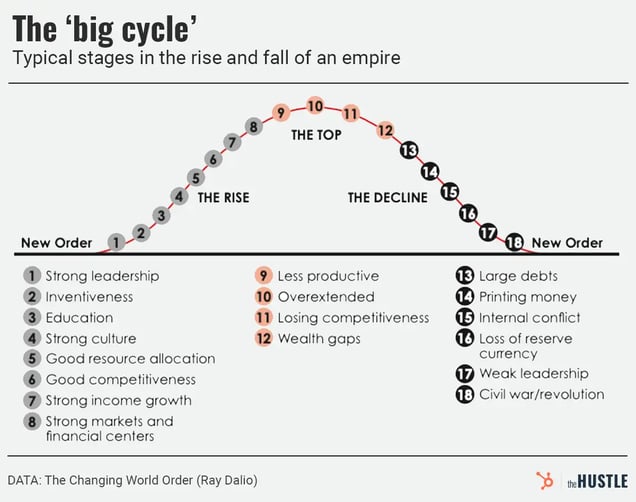

You have this interesting chart in the book that maps out the major characteristics in the rise and fall of an empire, based on 500 years of historical data. Where do you see the US right now in this cycle?

The Changing World Order (Ray Dalio)

Well, I think we’re relatively late in the cycle.

We’re in the riskier part of the cycle, which is the cycle right before wars. But that doesn’t mean a war is inevitable.

Really, it all comes down to how we are with each other. The world has more resources, more wealth, than it ever had. If we work together to share of the wealth and the opportunities, you can avoid wars.

We’ve heard a lot of prominent voices weigh in on a possible impending recession. Jamie Dimon, the CEO of JPMorgan Chase, recently said a “hurricane” is coming. What are your thoughts on that?

I believe that we will be in a relatively extended period of stagflation.*

We have inflation, which takes buying power away. And the central bank is going to fight it by making credit less available and raising interest rates, which takes even more buying power away.

[*Stagflation: A period in which the inflation rate is high and the economic growth rate slows.]

How do you generally think about moments of volatility, like the one we’re in now, from an investing vantage point?

I would worry about holding assets that are prone to deflate.

When you hold a bond or a money market fund, you’re going to get an interest rate [that] is substantially below the inflation rate, so you’ll lose buying power. Diversify well.

[If I were] to pick countries [for foreign investments], there are three questions I’d ask:

- Is the country earning more than it’s spending?

- Does it have internal order where people are working well with each other to be productive?

- Is it at risk of being drawn into an international war?

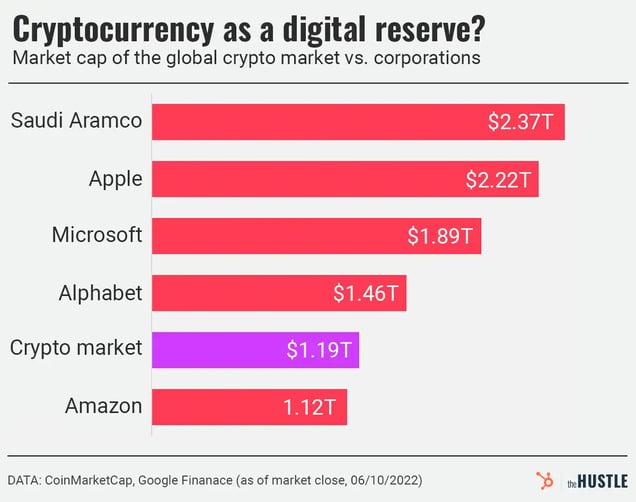

There’s a growing movement to make bitcoin a reserve currency.* Do you see a future there?

I think bitcoin has been a tremendous accomplishment. But I don’t think central banks are going to hold it as a source of reserves.

It’s decentralized, but at the end of the day, governments can still monitor and control it. And the biggest problem with governments is that right now they have their own money problem and you can’t trust them. If bitcoin became too much of a good alternative, they’d get rid of it.

We talk a lot about bitcoin as an alternative, but its total value is relatively small [~$556B, as of publication]. I think too much is being made of it.

[*Reserve currency: A foreign currency that is held in large quantities by central banks for international transactions and investments.]

The Hustle

All right, let’s shift to you now. There were two financial bets that you made that had a huge impact on your career. One was really bad and the other was really good.

The bad: You started Bridgewater in 1975. In 1982, you incorrectly predicted the coming of an economic crisis and you pretty much lost everything. You had to borrow $4k from your dad to pay the bills. What did you take away from that experience?

Oh, it was one of the most painful experiences that happened to me. But also one of the best.

What I took away was a different way of thinking. It gave me a humility that balanced my audacity. It made me ask myself, “How do you know you’re right?” And I developed a principle: Pain + Reflection = Progress.

I learned how to diversify better. I learned how to be more open-minded and [try] to have my ideas stress-tested by other people who disagree with me.

The good: you anticipated the 2008 recession and made your investors a sizable return when almost everyone else was hemorrhaging money. What did you see there that others missed?

I went back and studied history.

I studied the 1929-33 debt bubble and burst,* and I understood it mechanically. What I was seeing in 2007-08 was identical.

It’s a good example of how people can miss out on something because it never happened before in their lifetime. But by studying the past, I was able to anticipate it. Bridgewater made a lot of money when others lost a lot of money because we understood the nature of dynamics.

[*1929-33 bubble and burst: Between 1929 and 1933 (the worst years of the Great Depression), industrial production fell by 47%, GDP dropped by 30%, and unemployment soared to 20%.]

There’s a story about how you helped McDonald’s launch chicken nuggets. You were a commodities trader and an adviser early in your career. In the early ’80s, McDonald’s had this new idea for a product, but there was a problem. And they came to you for help…

I had a large chicken producer as a client, and I had McDonald’s as a client. McDonald’s wanted to come out with the McNugget.

But the problem with the McNugget was if the cost of buying chicken varied a lot, they couldn’t put it on the menu. The price could go up. And they’d have big losses and then they’d either have to change the menu price, which would be a mess, or they would have to take these losses.

I knew the chicken producer. And I knew that the cost of producing a chicken is very small — it’s mostly the corn and soymeal that you feed the chick.

I knew that I could hedge that by being able to buy corn and soymeal futures so that they would lock in a chicken price. So I showed the chicken producer how he could do that and then gave a fixed price to McDonald’s.

Dalio helped McDonald’s launch their popular McNuggets (Photo by Chris Hondros/Getty Images)

You live by kind of a hyperrealist philosophy, in that most things in life are machine-like and conform to some overarching sense of order. What I find interesting about that is that your father was a jazz musician and jazz is all about breaking free from structures.

What role has improvisation played in your life?

Improvisation is an expression of creativity that comes from the subconscious.

I practice transcendental meditation, which brings me into my subconscious. When I align those subconscious thoughts with what is happening in my conscious mind, it helps me make better decisions.

I carry the effects of transcendental meditation through the day. And it gives me that equanimity, that calmness, to be able to approach things in a good way so I don’t get emotionally hijacked.

You’ve met a lot of successful people in your life — heads of state, dignitaries, some of the wealthiest people on earth. Would you say there are any common traits among highly accomplished individuals that you’ve met?

Yes.

I’ve actually done personality testing* on acquaintances and friends, including Elon Musk, Bill Gates, and Reed Hastings.

A few things they have in common:

- They’re very, very, very curious, and independent thinkers.

- They’re “full range” — they’re able to go from the full range of the big picture down to the smallest detail.

- They’re both systematic and creative. Most people who are creative may not be so systematic, and most people are systematic may not be creative. They tend to be both.

- They tend to hold people accountable. They have high standards for other people. Some people would say they’re rude or abrupt.

Most people at the top of their profession made it there because they must be very smart and very capable. Of course, that enters into it. But it’s really how they deal with what they don’t know.

[*You can learn more about Dalio’s personality tests here.]

Are there any life principles that you’ve rethought lately, or that have shifted over time?

The one that comes to mind, again, is Pain + Reflection = Progress.

I lost a son. That was the most painful experience of my life. At 42, he died in an automobile accident. It was the worst thing that ever happened to me.

I reflected quite a bit on death and life, and my relationship with him.

And related to that is the serenity prayer: “Give me the serenity to accept that which I can’t control, give me the power to control that which I can, and give me the wisdom to tell the difference.”

It seems like you’ve spent a large portion of your life trying to wrangle things in and make sense of things that are uncontrollable — markets, relationships, people.

That’s right. And one of the things I’ve learned is that whatever success I’ve had in life has been more due to my knowing how to deal with what I don’t know.

I have a principle: “If you worry, you don’t have to worry. And if you don’t worry, you need to.”