WTH is Adam Neumann’s startup anyhow?

Adam Neumann’s back with a real estate startup already valued at $1B. But… what is it?

Published:

Updated:

Related Articles

-

-

The Carta debacle, explained

-

Cloudy with a chance of downfalls: The year ahead for startups

-

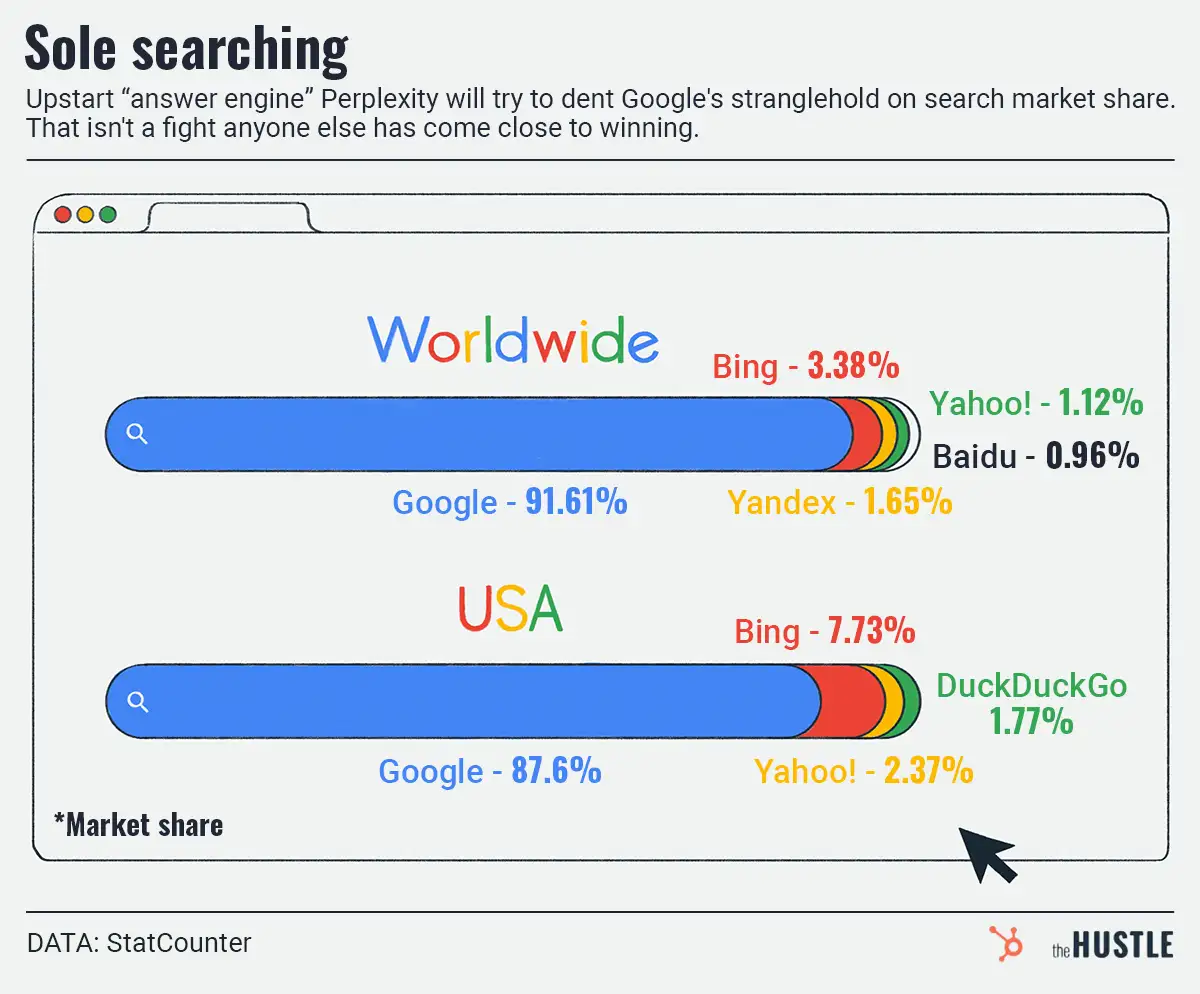

Could a Bezos-backed search startup kick Google’s crown off?

-

Adam Neumann’s apartment startup is here

-

What the heck is going on with Airbnb in NYC?

-

Why tech workers are sleeping in expensive boxes

-

Branded residences aren’t just for hotels anymore

-

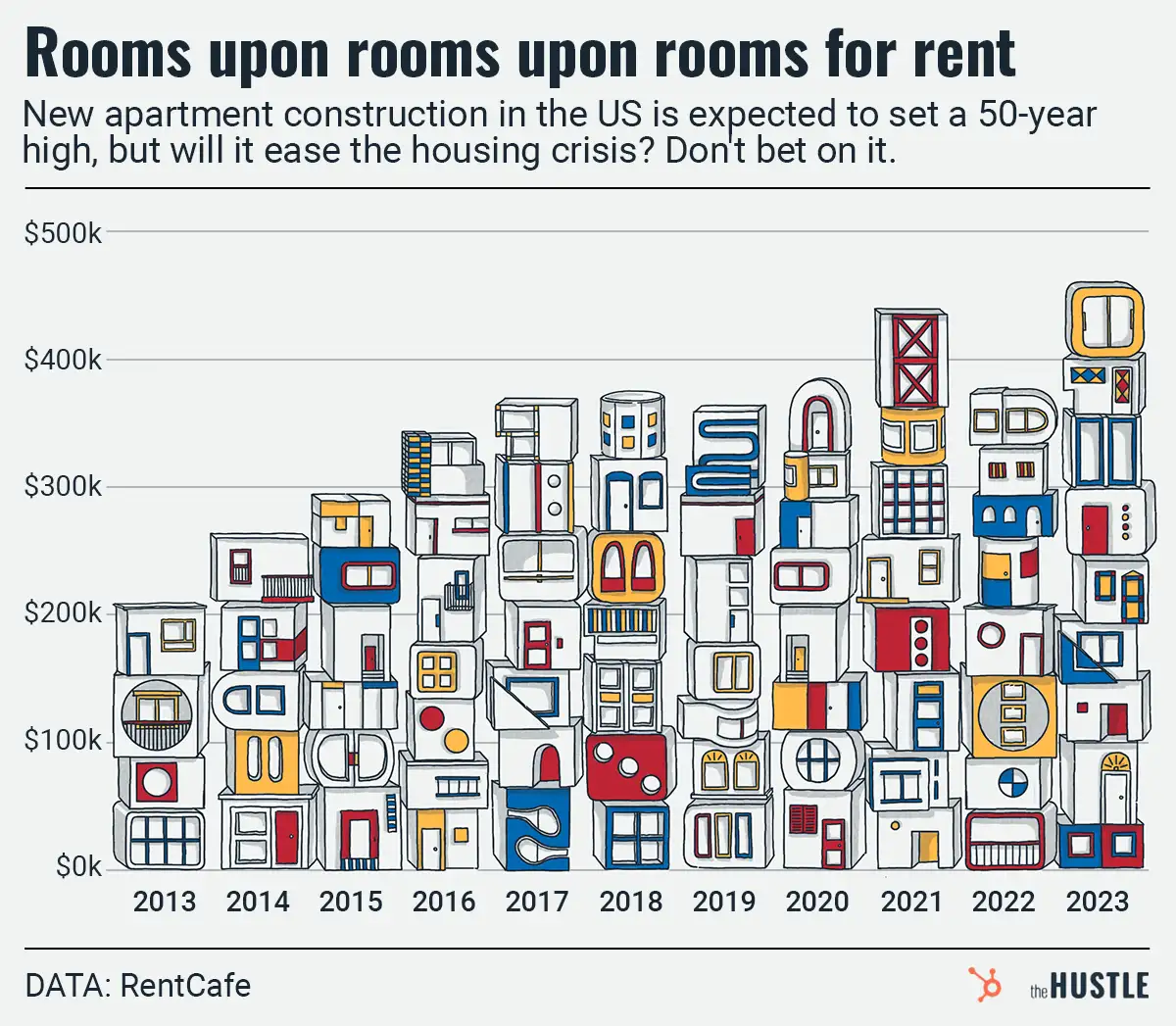

Apartments are getting built at a record clip — it’s too bad they aren’t the right kind

-

Will the Bay Area get a new city?