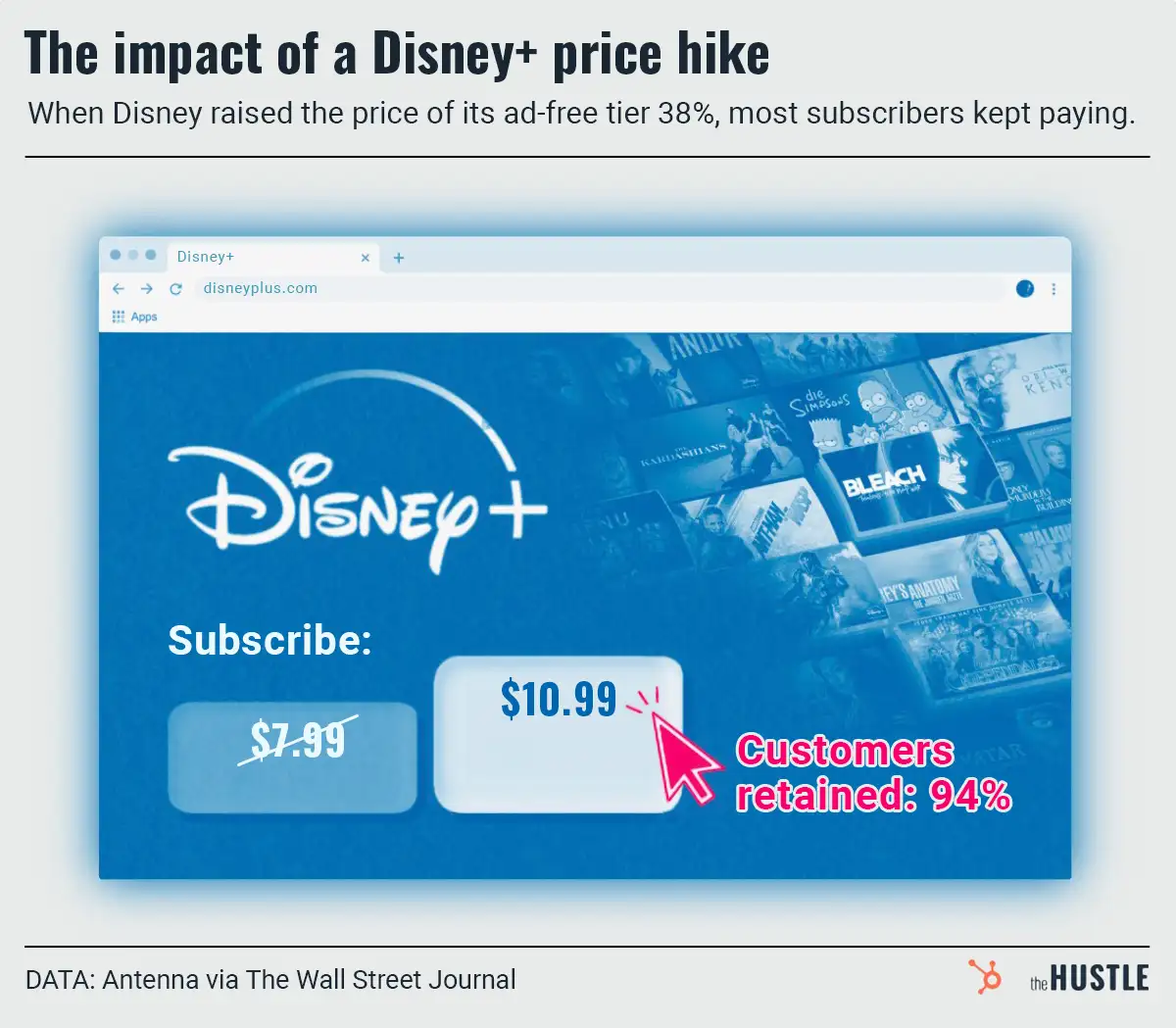

Here’s a rundown of popular streaming services:

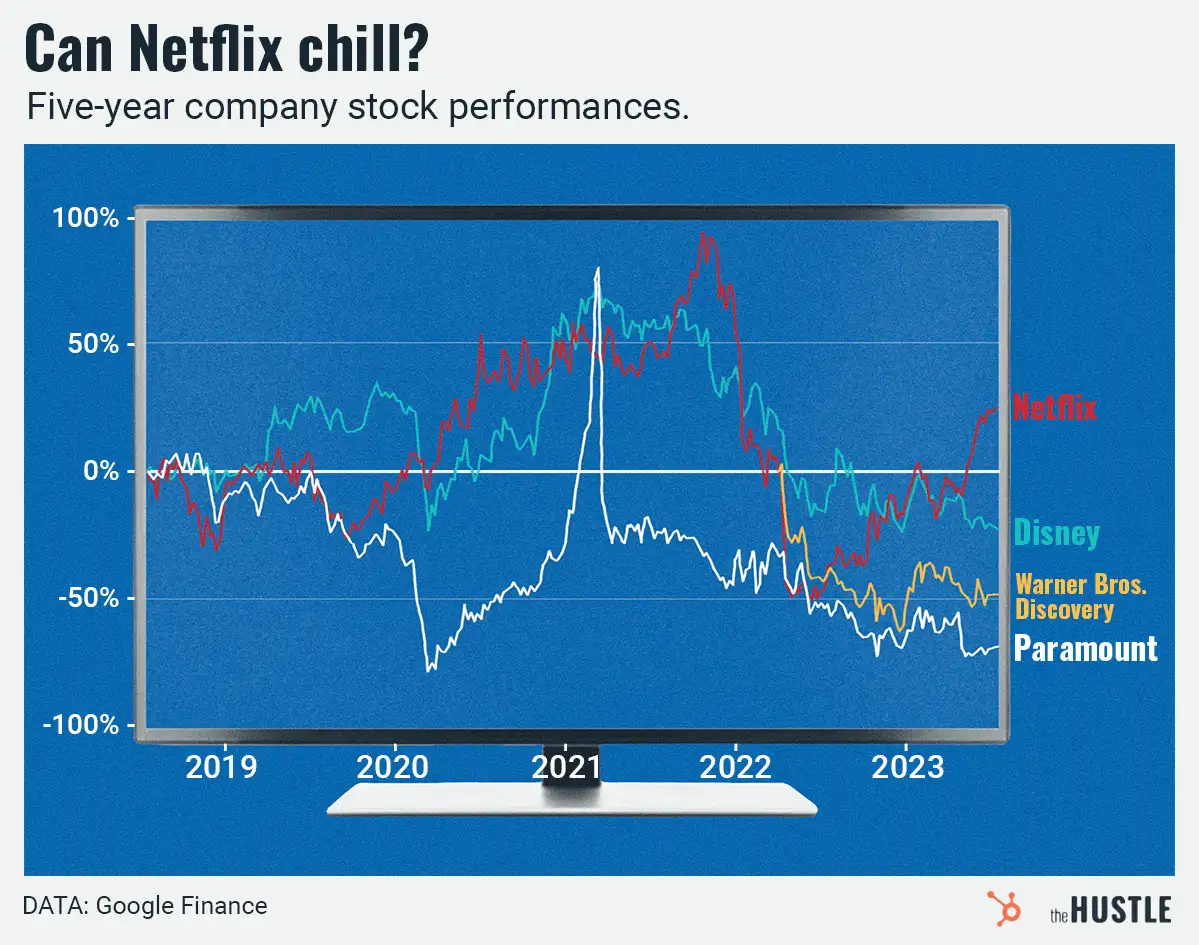

- Disney+ is home to Marvel, Star Wars, Pixar, and more

- Netflix — which is spending $17B on content this year — is home to originals like Tiger King and F1’s Drive to Survive

- Peacock has The Office and probably nothing else worth watching

Now, we’ll have to familiarize ourselves with a new offering:

AT&T will spin off its content unit WarnerMedia…

…and combine it with Discovery to create a media business that could be worth as much as $150B, per CNBC.

If the deal is approved by regulators, this new content giant would be home to CNN, HBO, TBS, Warner Bros., Discovery Channel, TLC, HGTV, Animal Planet, and — probably the most important — Food Network.

A huge pivot for AT&T

Just 3 years ago, the telecom giant closed an $85B deal for all of Time Warner’s media assets. Clearly, its attempt to combine content and distribution didn’t strike gold.

AT&T is slated to receive $43B as part of its deal with Discovery, and its shareholders will own 71% of the new business (Discovery owns the balance).

WarnerMediaDiscovery (not the company’s official name) will be run by Discovery’s CEO David Zaslav. According to CNBC, the future of WarnerMedia’s head Jason Kilar — who founded streaming pioneer Hulu — is “uncertain.”

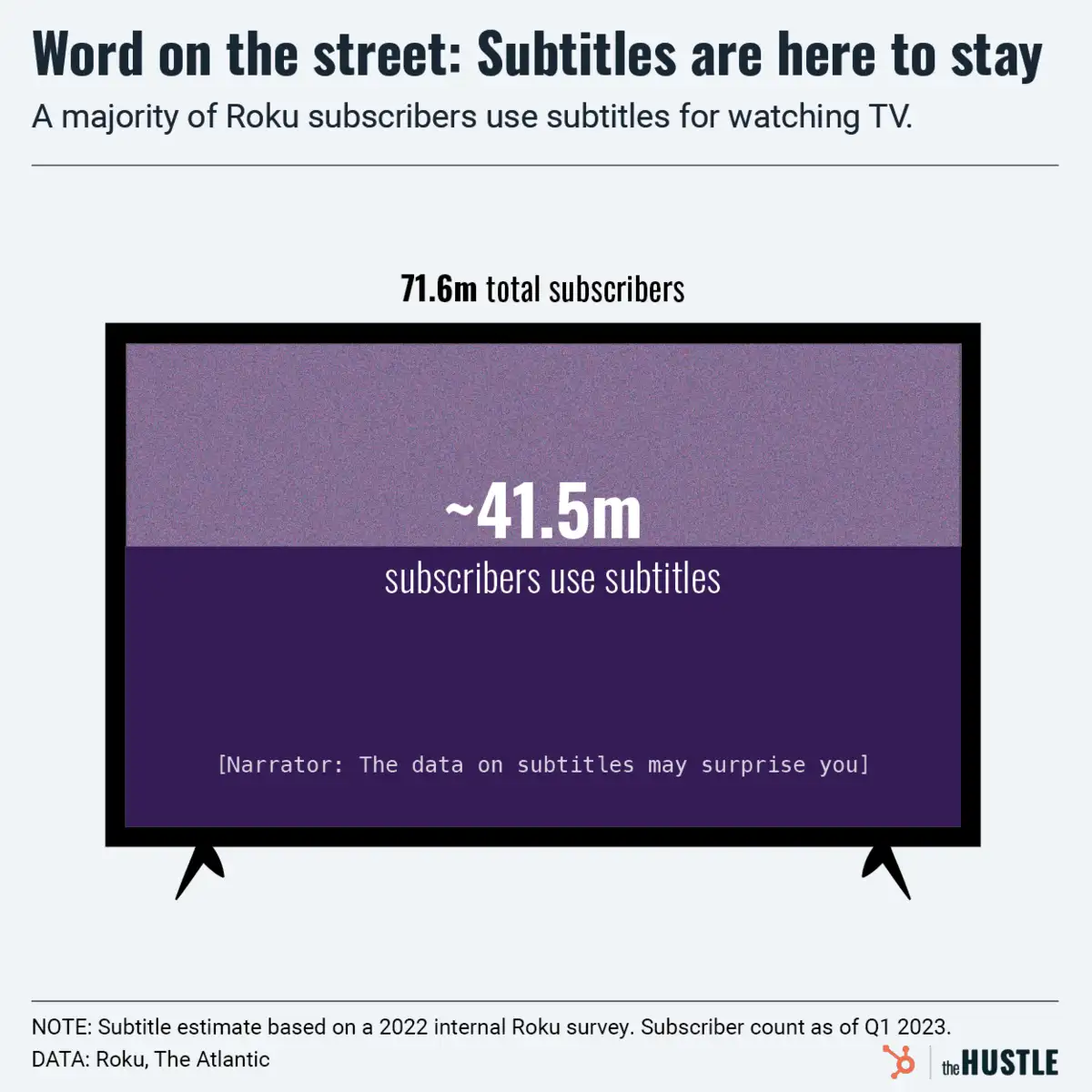

WarnerMediaDiscovery would have 79m paying subscribers…

… across the HBO Max (64m) and Discovery (15m) services. While the figure falls short of Netflix (200m+) and Disney+ (100m+), the combined entity would be in a stronger position to compete (400m subs is the goal).

This consolidation also puts pressure on ViacomCBS and NBCUniversal to scale up.

When it comes to streaming, though, we just have one question: When is the next season of HBO’s Succession?