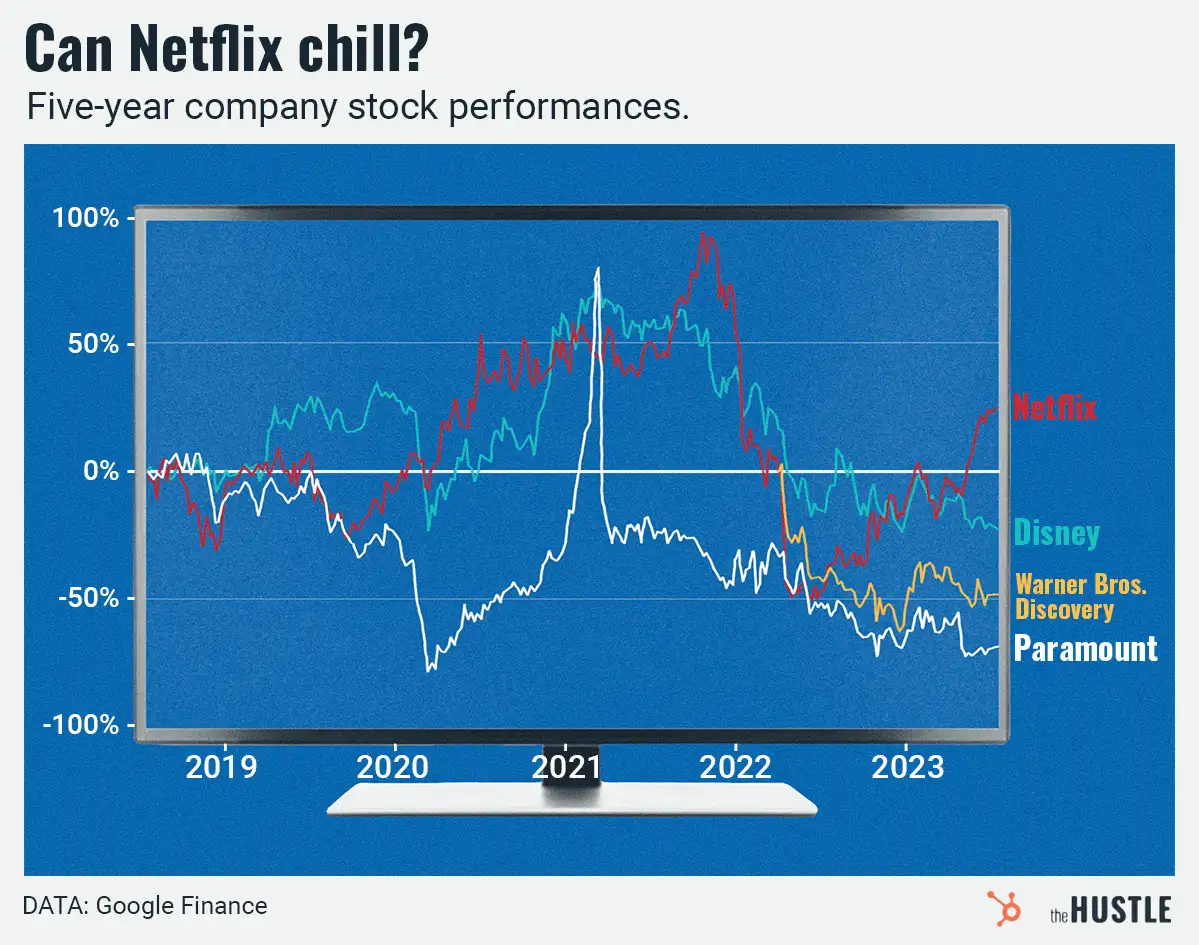

For those in the streaming biz, 2020 was a blast from start to finish.

But for the sports-focused streaming service FuboTV, that blast was particularly wild.

Since going public in October, FuboTV has seen its stock skyrocket almost 500%, only to plummet 50%+ from its mid-December high of $62.

Much of the yo-yo-like volatility comes as Fubo has turned into what the investment community calls a “battleground stock,” with long and short analysts bitterly debating the company’s future.

Fubo bulls point to recent earnings and acquisitions

In Q3, Fubo reported subscriber growth of 58% year-over-year to 455k and revenue growth of 71% to $61.2m. It also saw total content hours streamed increase 83% to 133.3m.

In December, Fubo bought fantasy sports software company Balto Sports with the aim of pairing Fubo’s content with Balto’s tech to build a live-sports gambling platform.

But it’s hard to gamble when you don’t have much to gamble on

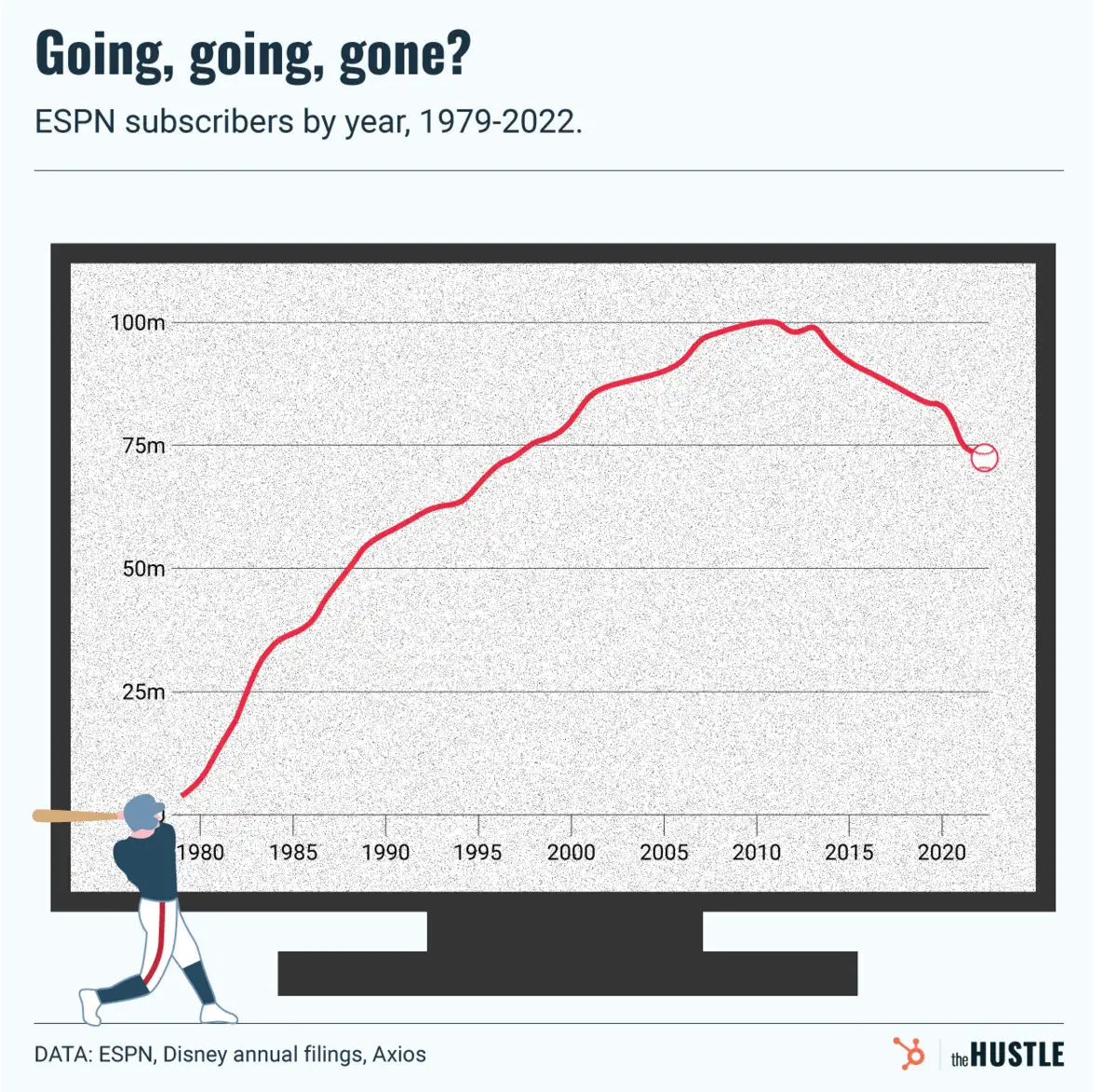

FuboTV recently lost the rights to networks that host games for the NBA, the MLB postseason, and the sports-gambling event of the year: March Madness.

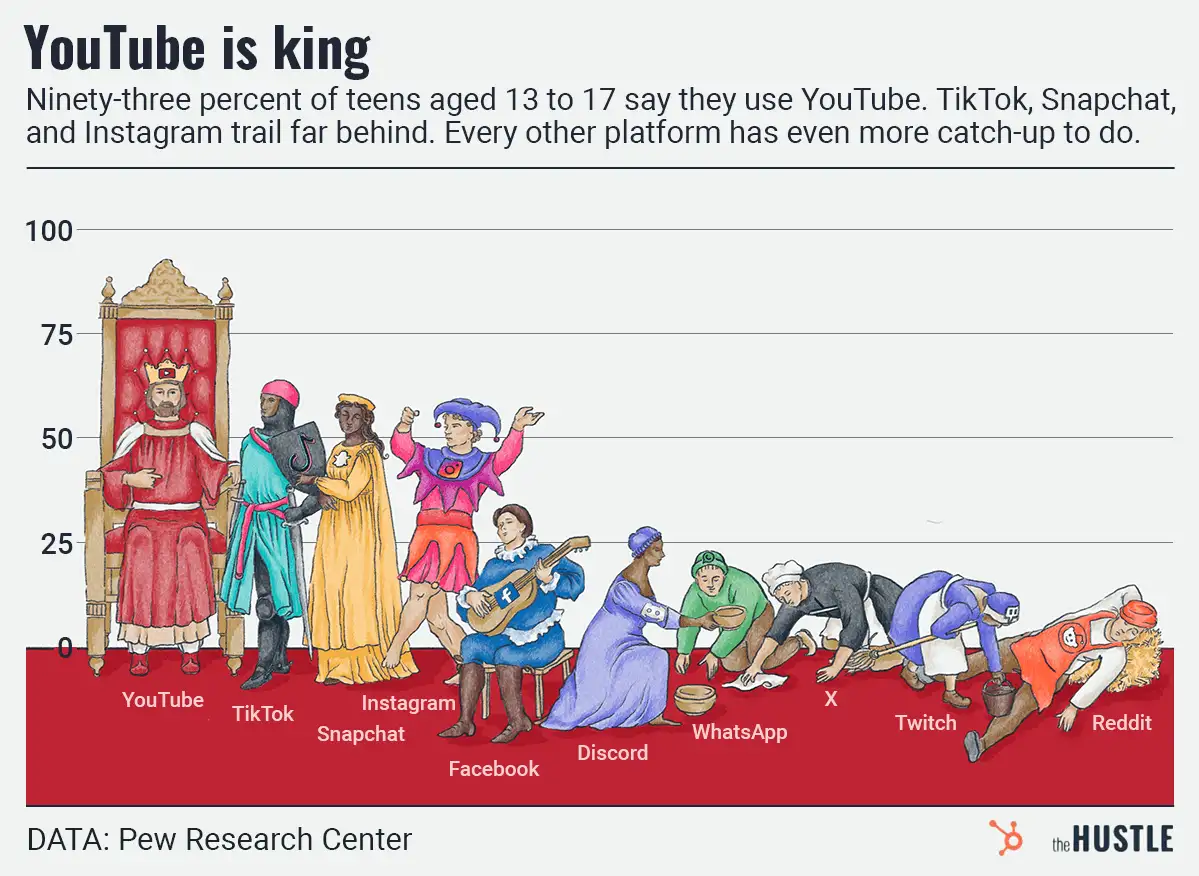

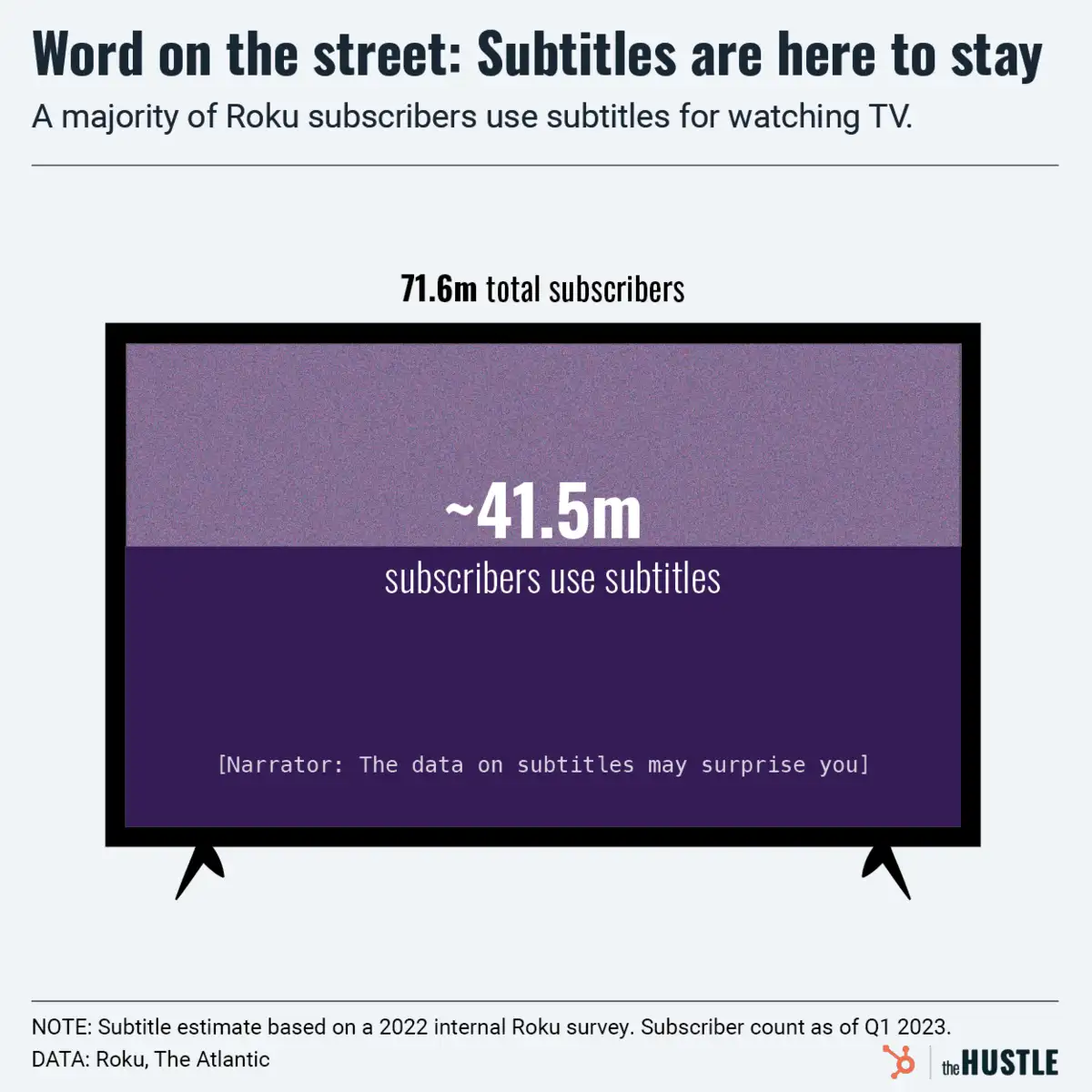

Add to that a shrinking market for live TV along with popular competitors like YouTube TV and Hulu + Live TV — with 3m+ and 4.1m subscribers, respectively — and FuboTV bears have a point.

In a real zinger, LightShed Partners’ Rich Greenfield gave FuboTV stock an $8 target, saying it “may be the most compelling short we have ever identified in our career as analysts.”

Ouch.

Check out more related coverage here: